Washingtonians love schools. Many of us grew up walking to our local elementary school, and we’ve dreamed of walking our own kids to school someday. I became a father on April 25, 2024; a week later, Seattle Public Schools announced that the elementary school I’d hoped to walk my kid to may close, along with nineteen others. Since then, they’ve repeatedly refused to tell us which schools, instead offering us a PR campaign disguised as a “presentation.” Parents and students in districts across the state face similar closures as school districts grapple with vicious cycles of falling enrollment and budget shortfalls.

As a new parent, I’m angry—like a lot of other parents who’ve been fighting school closures for years. As a lawyer, I know that we can’t just blame the school district, or state legislators, or even curtailed federal funding for our struggling schools. Washington’s Supreme Court has helped starve our schools of state revenue—their primary funding source—for years. To permanently fix school closures, Washingtonians must elect justices willing to reject decades of oligarchic attempts to rig our state constitution in favor of the wealthy. Thankfully, we’ll elect one new justice this year. Voters need to know whether these candidates will fix the mess their predecessors created.

The Washington Supreme Court’s Incoherent Approach to Education

Washington’s highest court has fought for schools with one hand while starving them with the other.

On the one hand, our Supreme Court has loudly championed Article IX, Section 1 of the state constitution, which gives our state government one paramount duty: providing every child in Washington with a quality education. A long line of state court decisions has explained that Article IX grants every Washington kid the right to a quality education, and our State Supreme Court has, at times, aggressively protected that right. In 2012, the Court found in McCleary v. Washington that the Legislature had violated students’ rights by failing to adequately fund education, touching off a six-year intergovernmental battle. Voters backed the Court, and legislators finally satisfied the justices by coming up with hundreds of millions in new funding from property taxes.

On the other hand, though, the same Court forcing legislators to fund schools was simultaneously choking off new sources of revenue. The Court has blocked taxes on the wealthy that could more than satisfy the state’s paramount duty since 1933, when five justices bowed to pressure from rich Seattle business interests and invalidated an income tax overwhelmingly passed by popular initiative.

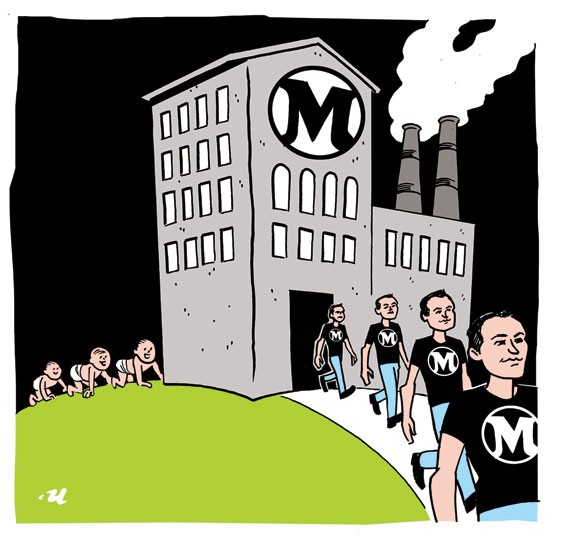

The Court’s decision in that case, Culliton v. Chase, created three myths: First, that there are only two types of taxes, excise taxes—taxes on the privilege of doing business—and property taxes; second, that income taxes are property taxes under the Washington constitution; and third, that all Washington property taxes must be strictly uniform. The Culliton Court also claimed, falsely, that the justices were respecting precedent by following previous decisions that had already decided income taxes were unconstitutional property taxes.

By invalidating a popular tax on the wealthy in 1933, Washington’s Supreme Court justices allowed themselves to become political pawns beholden to wealthy, anti-democratic interests—a preview of similar tactics used today by elitist groups such as the Federalist Society. By bowing to powerful elites, the Court forced the Legislature to create a wildly unstable, unfair tax system relying on property and sales taxes paid by working families. Simultaneously, the Court effectively exempted wealthy Washingtonians and large corporations from taxation—starving public institutions, especially schools, of necessary funds.

Even the Court itself recently acknowledged that its incoherent approach to taxes has created a political nightmare; Washington’s wealth inequality has exploded, and we now have the second-most unjust tax system in the country—only Florida’s is worse.

The Court Refuses to Fix Its Own Mess

Unfortunately, Washington’s justices recently refused to end this political nightmare by giving the Legislature back its constitutional authority to tax the rich and fund schools. In last year’s Quinn v. State decision, the Court rejected the opportunity to abandon its 1933 Culliton decision rigging Washington’s taxation scheme in favor of the rich. While the Court did approve the Legislature’s popular—and wildly successful—capital gains tax, the justices also explicitly declined to revisit Culliton. Although the justices acknowledged that the Court had the authority to reject incorrect and harmful precedent—and Culliton certainly is both—they decided to issue a much narrower decision that left Washington’s dysfunctional, unjust taxation scheme largely untouched.

By allowing Culliton to live, the justices permitted rich ideologues to inhibit school funding by delaying any new wealth taxes—not just old-school income taxes—with frivolous, years-long lawsuits. The capital gains tax, for example, took nine years to pass in the Legislature and two years to work its way through the courts before finally being implemented—and yielding almost $900 million in revenue for schools. Washington’s Supreme Court could have used Quinn to close the door on future lawsuits by admitting that Washington’s populist constitution grants the Legislature broad authority to fund education by taxing the rich. Instead, the court allowed illegitimate, undemocratic, Depression-Era precedent to stand, even at the expense of our kids’ right to a quality education.

Now, any new tax will face the same silly, unnecessary legal fight over which type of tax it is, with judges—not voters, legislators, teachers, or policy experts—having the final say. Judges got us into this mess, and, thanks to state constitution age limits, voters will pick new justices this year, in 2026, and in 2028. Washington voters must elect justices willing to get out of the way and allow the Legislature to amply fund education.

Austin Field is a public defender in Seattle. Before attending law school at the University of Washington, he was an Army infantry officer, a law firm operations manager, and a public defense investigator. The views expressed are his own.