If you have any, the scholarly encounters with eighteenth-century Scottish thinker Adam Smith you recall most vividly may go something like this: You’re a high school history or undergrad econ student. Lo, an “invisible hand” force feeds free-market ideas into your credulous synapses foie-gras style—and, all the while, you scribble silly little notes on “laissez-faire” ideals and the worship of market forces as a perfect determinant.

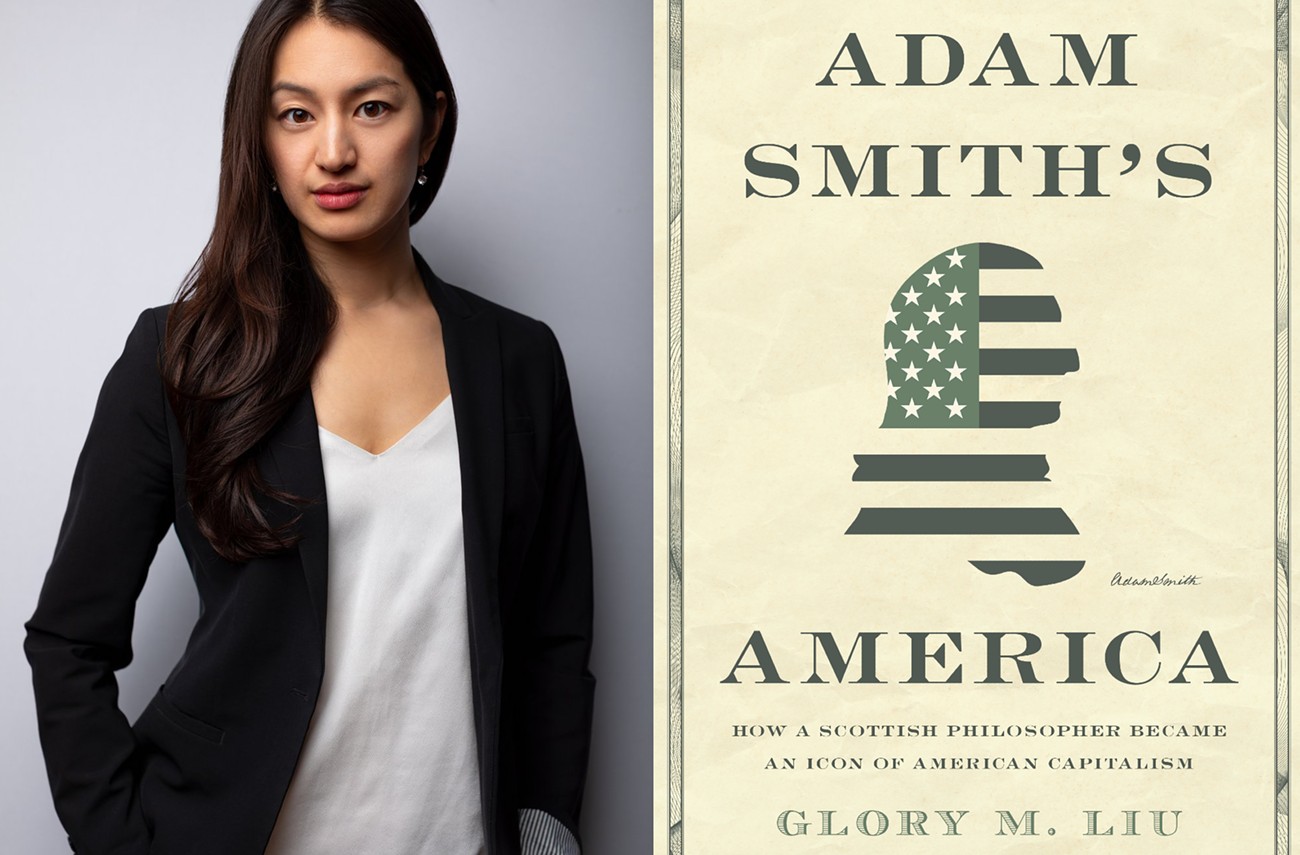

Repulsive and cringe, says I! As well as ahistorical and monolithic, says Glory M. Liu, author of Adam Smith’s America: How a Scottish Philosopher Became an Icon of American Capitalism.

To Liu, the Adam Smith most familiar to US publics is the phantasmagoric lovechild of politicians and theorists who, across centuries, have built idealized versions of Smith to achieve particular political goals. Not unlike scripture in that sense—a selective sentence wielded here to justify a particular thing, an antonymic snippet there for the obverse.

Despite his near-mythical status, not much is known about Smith, Liu tells us. Like most writers named Adam, Smith was, in fact, just some guy. Not exactly a looker either; history (read: correspondence between super judgy French people who saw Smith during his visits abroad) suggests he was “ugly as the devil.” Which maybe explains why only two visual depictions of him survive—fewer than expected given how long his words have stuck around. But even his writings are in relatively short supply. Smith, a perfectionist, ordered his unpublished manuscripts to be burned upon his death, which is so goth, but it leaves us with only student notes (useful ones!) to reconstruct his lectures, along with two major published works, The Theory of Moral Sentiments and The Wealth of Nations.

Smith’s legacy overcame that paucity thanks to his books’ style. The Wealth of Nations in particular gained a foothold in the US through the study of political economy, an interdisciplinary science “which teaches to obtain the maximum of Good with the minimum of Expenditures,” as one now-long-dead professor defined it. Smith’s ability to string words together in nice, understandable ways made The Wealth of Nations a useful text for students, establishing Smith to nineteenth-century intellectuals as the “father of political economy.”

But those books are bigguns, and passages therein can contradict arguments made by Smith elsewhere. We all contain multitudes, and Smith is no exception. It’s therefore both telling but unsurprising that Antebellum proponents of “Southern free trade,” as in chattel slavery, evoked the “authority of Adam Smith” to endorse an economic system that, in their eyes, promoted the “patriotic spirit of a free people,” with “free” being an intentional and white-supremacist fraction; and that abolitionist lawmakers wielded other Smithian passages to underscore the cruelty of people who enslave others. Then and now, Smith’s relative malleability makes him moral and rational fuel for a range of agendas.

This means you’ve encountered Adam Smith far beyond the classroom, whether you knew it or not; and we can, in no small part, blame the Midwest for that, namely the Chicago School of Economics, which shamelessly held the Scottish thinker—and, by extension, us—hostage to their idea of him. Rhyming with Justin Bieber’s cursed visit to the Anne Frank House, Milton Friedman, high priest of the Chicago School, ballsily venerated Smith as a thinker “who but for the accident of having been born in the wrong century… would undoubtedly have been a Distinguished Service Professor at The University of Chicago.” Further decoupled from the moral frameworks of his first book, rendering economics a question of numbers alone rather than a moral discipline, the Chicago version of Smith grew into an “invisible hands only” kind of guy.

We can’t singularly attribute the Chicago School’s success to how it deployed Smith as currency—thank political receptiveness in the form of vitriolic anticommunism and greed, idk—but the School’s successful co-optation of Smith helped its ideology claim a storied legacy, grow legs off campus, and eventually shape King County and other places in its image. Chicago Price Theory, which posits that prices can fully explain the behaviors of buyers and producers, helps render a balls-to-the-wall, potentially bankrupting money pit like the SR 99 Tunnel appear a seemingly rational endeavor deserving public debt. This same thinking sustains green capitalism and the market-centric political agendas of local oligarchs like Bill Gates, who see carbon pricing and offsets as satisfactory paths to decarbonization, despite plenty of local and global evidence to the contrary.

“Perhaps the greatest consequence of the Chicago Smith was the way it served to reframe the problems of modern American capitalism and modern society as problems that stemmed from government, rather than the market itself,” Liu concludes. That shift has affected poor and disenfranchised people most acutely. Friedman, the shameless epitaph-prone prof, repackaged Smith’s writing on how monopolies wield undue political influence to claim that “trade unions, school teachers, welfare recipients, and so on and on” were “‘tribes’ of ‘monopolists’” too, intentionally confounding labor movements with the supposed ills of “big government,” thereby justifying the destruction of both. Chicago School thinking was adopted by Democrats and Republicans alike, informing the Clinton-led disembowelment of the welfare state through the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 under the guise of “bipartisanship,” as well as the overturning of the Glass-Steagall Act, signed in 1933 to prevent the kind of profiteering and volatility that helped spark the Great Depression. These windfall legislative changes contribute to Seattle’s Janus-faced economic landscape: at once deeply unaffordable for some and profoundly lucrative and speculative for others.

Across Adam Smith’s America, Liu emphasizes how public perceptions of Smith—and, by extension, what economics should accomplish—can shift during periods of major change. Forrest Gumping his way across intellectual history, Smith stays frustratingly relevant due to his authority and breadth; he can even come in regional flavors. If shit really hits the fan in Seattle’s teetering tech sector, for instance, where a deluge of layoffs leaves a managerial overclass reeling, and more importantly, risks effectively deporting thousands of H-1B visa holders and their families, there’s a possibility we’ll see new rebukes of the “move-fast-break-things” logics of bluechip capitalism, rejections of capital’s borderlessness at the expense of people’s, and critiques of mealy-mouthed euphemisms like “market corrections,” which Smith would tell us is a decidedly moral and economic term. Maybe it’s a moonshot to imagine lanyard-festooned Seattleite techies as a revolutionary vanguard, but, whatever your political visions: There’s a Smith for that.